Bitcoin has spent fifteen years proving one thing better than any asset on earth. It settles value with absolute reliability. It does not bend, inflate or break. It has become the world’s most secure Settlement Layer and the foundation for a global store of value. What it has not become is a productive asset. That next chapter will not take place on Bitcoin itself. It will happen on the Execution Layers that surround it.

This shift is already underway. Strong macro conditions, the arrival of spot ETFs, and a changing investor base have pushed Bitcoin deep into the mainstream. The question allocators now face is no longer whether Bitcoin belongs on a balance sheet. It is how to begin monetising it without weakening the very asset they spent years accumulating.

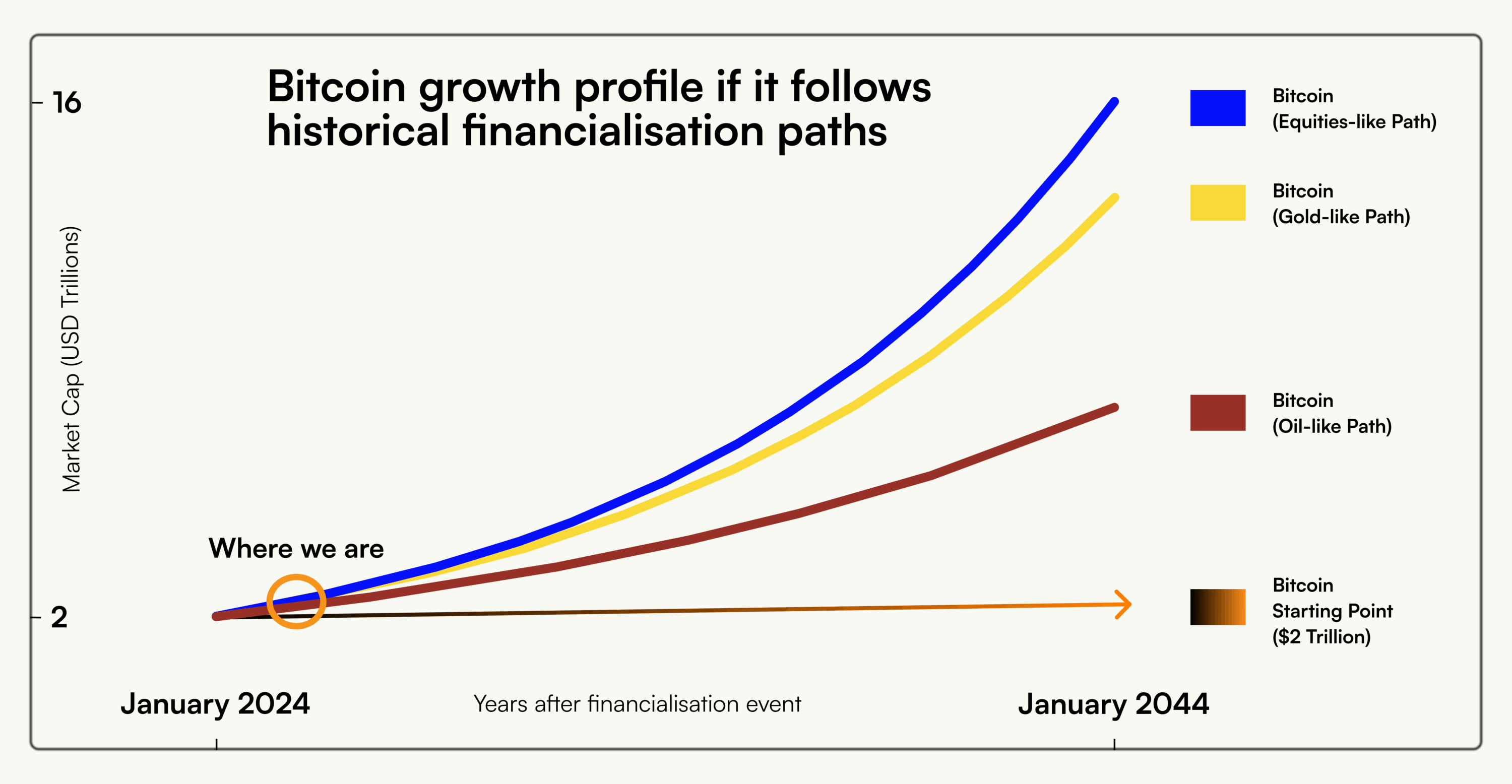

Across every major asset class, yield has been unlocked. Gold reached scale once certificates, futures and ETFs transformed it into a financial product. Oil became a global financial asset once derivatives created new ways to trade and hedge it. Equities only reached current depth and liquidity after lending, options and structured products allowed investors to generate income and manage exposure. Bitcoin is on the cusp of the same transition. The only question is who will lead it.

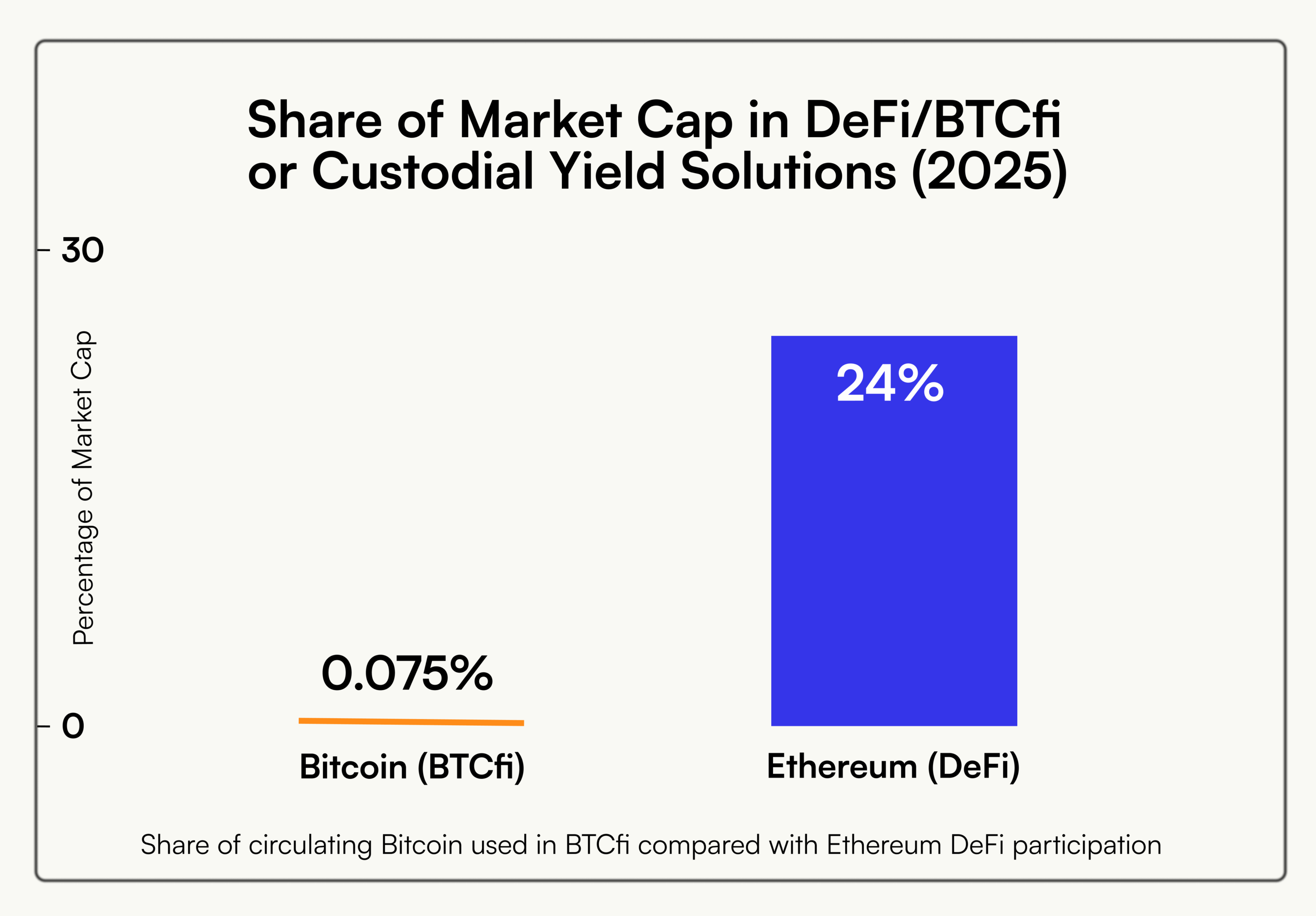

Today the gap between Bitcoin’s size and its level of financialisation is extraordinary. A two trillion dollar asset with less than 0.1 percent deployed in BTCfi. A lending market that reaches only one percent penetration while securities lending in equities sits closer to seven. These numbers show both the magnitude of the opportunity and the structural work required to unlock it.

Custody risk, bridging fragility, weak underwriting, inconsistent transparency and a risk / reward relationship that simply does not make sense. These are the real barriers. Not philosophy. Not culture. Until these structural weaknesses are solved, Bitcoin yield will remain fragmented and dominated by opportunistic flow rather than serious capital.

This is why the Execution Layer is becoming the battleground.

Bitcoin will always remain the pristine Settlement Layer. It is not designed to carry the financial infrastructure required to generate yield at scale. To collateralise it, lend it, structure it or build products around it, Bitcoin must move into environments that can support programmability and capital markets activity. That movement is unavoidable. The race is not about whether Bitcoin will be financialised. It is about which Execution Layer can make that path trustworthy enough for institutional adoption.

The early signals of financialisation

Bitcoin is already behaving like every asset class that has gone through this transition.

Like gold, it is widely recognised as a store of value.

Like oil, its volatility creates opportunities for derivatives and structured strategies.

Like equities, it is beginning to support lending and secondary yield markets.

Large holders do not want to sell. They want to monetise without sacrificing exposure. Many have already begun exploring Execution Layer solutions to enhance performance. This is the natural progression for any asset with scale and a maturing holder base.

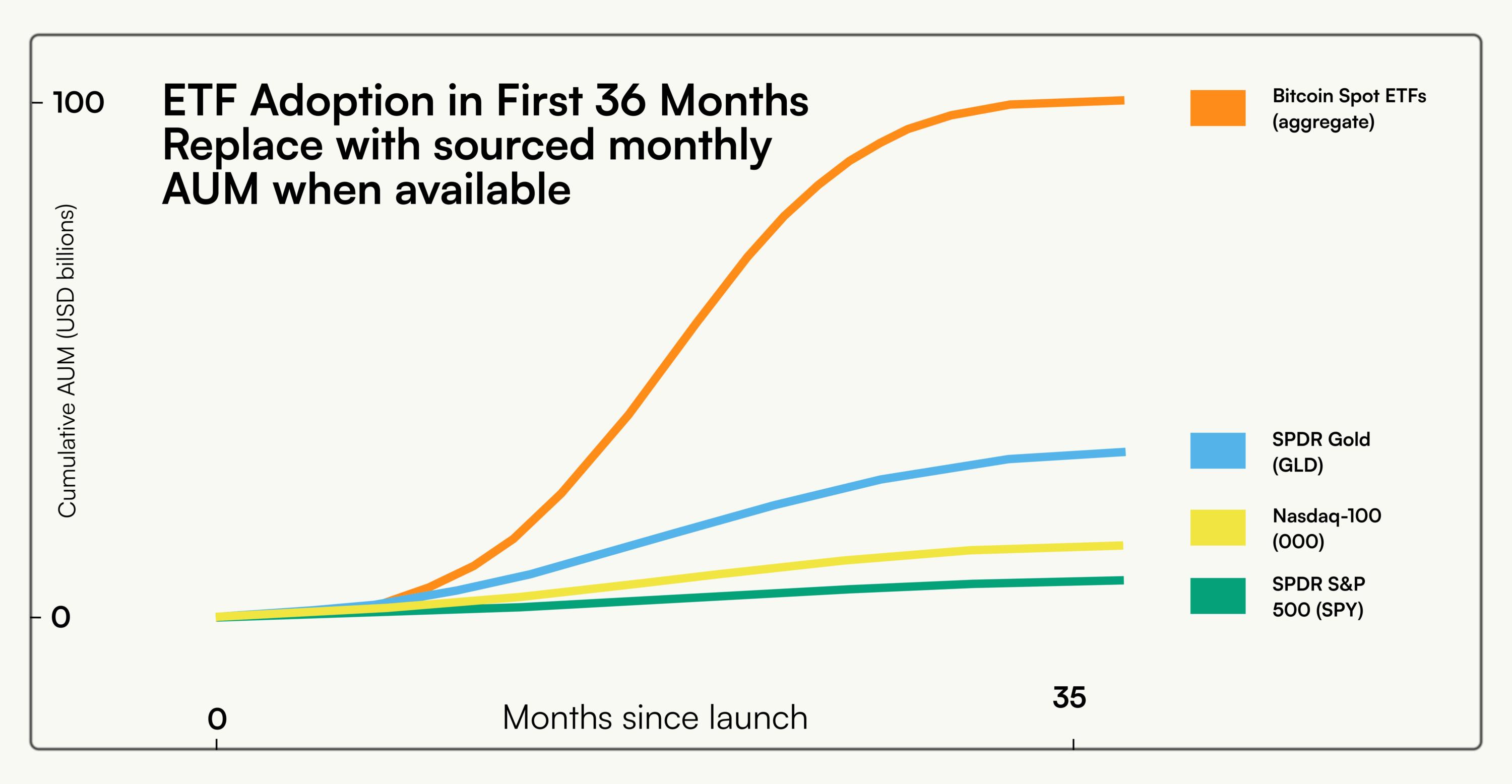

If we take the launch date of the first US ETFs (January 2024) as day 0, then we are only two years in and we can start to understand just how early we may be.

Once an asset becomes financialised, liquidity, innovation and institutional inflows accelerate. Bitcoin is still early in that journey, but the direction is clear.

The market today shows both scale and underdevelopment

Bitcoin commands a market cap near two trillion dollars, yet only a fraction of it has been monetised. Ethereum supports more than one hundred forty billion dollars worth of staked assets because it offers native yield. Bitcoin has no native yield and every method of monetisation must be manufactured through structured products, lending markets or Execution Layers.

Six and a half billion dollars is currently locked in BTCfi, but five billion of that sits in Babylon staking. The real number is closer to one and a half billion. That means only 0.075 percent of Bitcoin’s market cap participates in BTCfi.

Outstanding Bitcoin backed loans total twenty billion dollars. That is one percent penetration. In equities, securities lending reaches five to seven percent.

Share of circulating Bitcoin used in BTCfi compared with Ethereum DeFi participation.

The participants and the hesitation

The yield landscape is fragmented. Credit markets, custodial solutions, Execution Layers, wrapped Bitcoin issuers, structured product providers and on chain managers are all building scaffolding for a future market. But commitment from allocators remains limited.

Smaller Digital Asset Treasuries are beginning to test infrastructure with small allocations. On chain native treasuries and DAOs face less operational friction when generating on chain BTC yield, so they are already scaling participation faster than traditional allocators. Large DATs, professional allocators and institutional treasuries remain hesitant for reasons that are rational and straightforward.

Bridging introduces risk.

Wrapped Bitcoin depends on the credibility of issuers.

Regulation for wrapped assets is unclear in many jurisdictions.

Underwriting standards remain inconsistent across the market.

Most importantly, there is no un-incentivised, demand driven BTC yield product at scale with transparent credit and counterparty risk.

Illustrative ETF adoption curves in the first thirty six months.

Bitcoin ETFs solved product market fit because the instrument was simple, compliant and trusted. Bitcoin yield products must reach similar clarity.

This hesitation creates a paradox. Bitcoin is the cleanest collateral in the world, yet its financialisation lags far behind assets with far weaker fundamentals.

If Bitcoin reaches a five trillion dollar market cap and BTCfi penetration reaches five percent, that alone would unlock a two hundred and fifty billion dollar market for BTC denominated DeFi products. Also, if Lending reaches equity like penetration would add another two hundred and fifty to three hundred fifty billion.

The future will be defined by trust, track record and scale

Bitcoin’s holder base is changing. Professional allocators, sovereign entities, digital asset companies, fintech platforms and the expanding group of ETF issuers now hold more than 10% of all Bitcoin. Yet 99% of that supply remains unproductive, earning 0% yield while still incurring custody costs. For many of these holders, a competitive dynamic is emerging. If your peers hold Bitcoin, the next logical step to outcompete them is to monetise it.

DATs make this pressure visible. Publicly listed DATs collectively hold more than 979000 BTC, around 5% of circulating supply. In bull markets these reserves lift valuations. In downturns they create vulnerability. Without yield, DATs struggle to defend mNAV discounts because they lack recurring revenue, and passive DATs tend to drift below 0 mNAV over time as custody and holding costs drag them lower with no offsetting income.

Smaller DATs feel this strain even more sharply. The same is true for fintech platforms and earn programs competing for users in crowded markets. These groups are likely to adopt Bitcoin yield products well before traditional institutions.

Yield will begin with agile participants and expand toward institutional acceptance, following patterns that have played out many times in traditional finance.

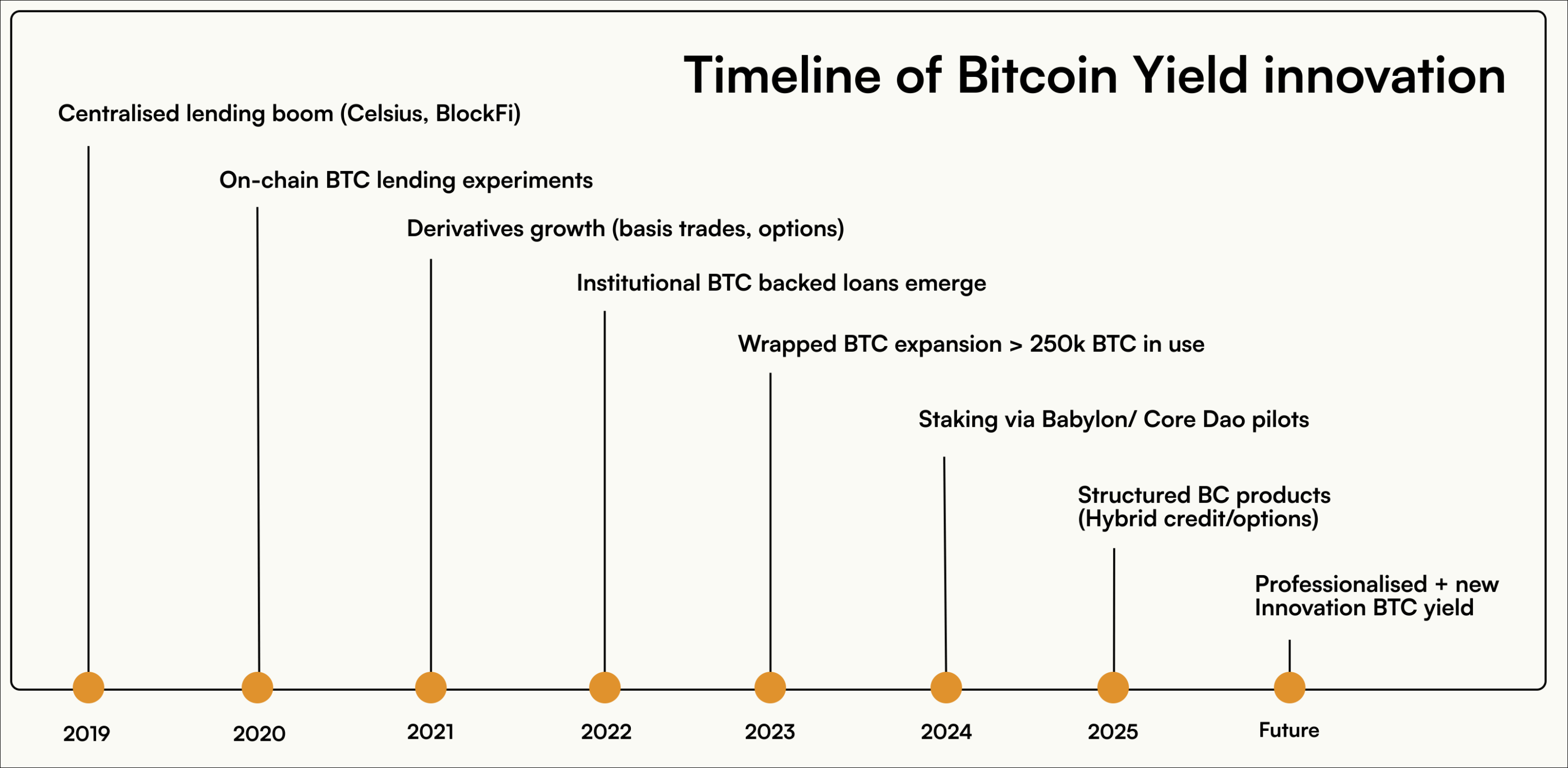

Every BTC yield product today is a structured product

Lending, derivatives, staking, hedged strategies, basis trades and wrapped yield approaches are all structured by design. None of them originate from Bitcoin itself. This is the defining challenge. For Bitcoin financialisation to scale, Execution Layers must structure yield that is attractive, transparent, risk adjusted and institutionally credible.

Timeline of Bitcoin yield innovation from early lending to structured BTC products.

The market is evolving quickly and the next generation of BTC yield will be more professional, more transparent and far more aligned with allocator requirements.

Where Rootstock leads

Rootstock is positioned as the longest-standing Bitcoin layer, with 100% uptime since 2018 and security anchored in Bitcoin’s Proof-of-Work through merge mining. It frames this longevity and PoW-aligned security as the foundation for unlocking BTCFi yield opportunities.

Rootstock’s growing ecosystem of 180+ partners is described as a mature environment for Bitcoin-native DeFi and yield use cases.

Solving the bridging problem

Over $10B in BTC now sits on other chains. Accessing smart contracts, yield, and tokenization requires bridging Bitcoin, but every bridge introduces trust assumptions. For institutions, the critical question isn’t “can I bridge?” but “who do I trust when I do?”

Allocators need clarity on how wrapped assets work, the assurance of third party audits, redundancy protections and clear legal guidance. Rootstock differentiates itself by providing a transparent bridge framework, full technical documentation, third party audits, insurance structures and white glove support for allocators assessing risk.

Rootstock’s answer is PowPeg. PowPeg is Rootstock’s lock and mint bridge, live since early 2018. It locks BTC directly on the Bitcoin blockchain and issues a 1:1 equivalent (rBTC) on Rootstock, which is merge-mined with Bitcoin.

PowPeg is framed around the following institutional advantages:

- Bitcoin-aligned custody: BTC never leaves the Bitcoin blockchain.

- Operational neutrality: withdrawals enforced by protocol, not people.

- Fail-safes: emergency recovery and redundancy built in.

- Auditability: open source code, attested hardware, verifiable escrow balances.

Track record: the longest-running Bitcoin bridge in production.

Balancing risk, reward, and quality underwriting

Allocators will not risk Bitcoin for ultra low returns if they also have to take on bridge, custody, counterparty and smart contract exposure. If the risk stack is real, the return has to justify it, and the risk has to be easy to measure.

This is where Rootstock does more than describe the problem. The direction is to make yield exploration match the investor: different paths to access yield based on risk profile, portfolio, and type of investor. Institutions have two routes to evaluate side by side:

- A diverse ecosystem of institutional-grade partners to explore yield opportunities across strategies and venues.

- Tailored products designed specifically for BTC investors, built to make risk and return easier to underwrite and compare.

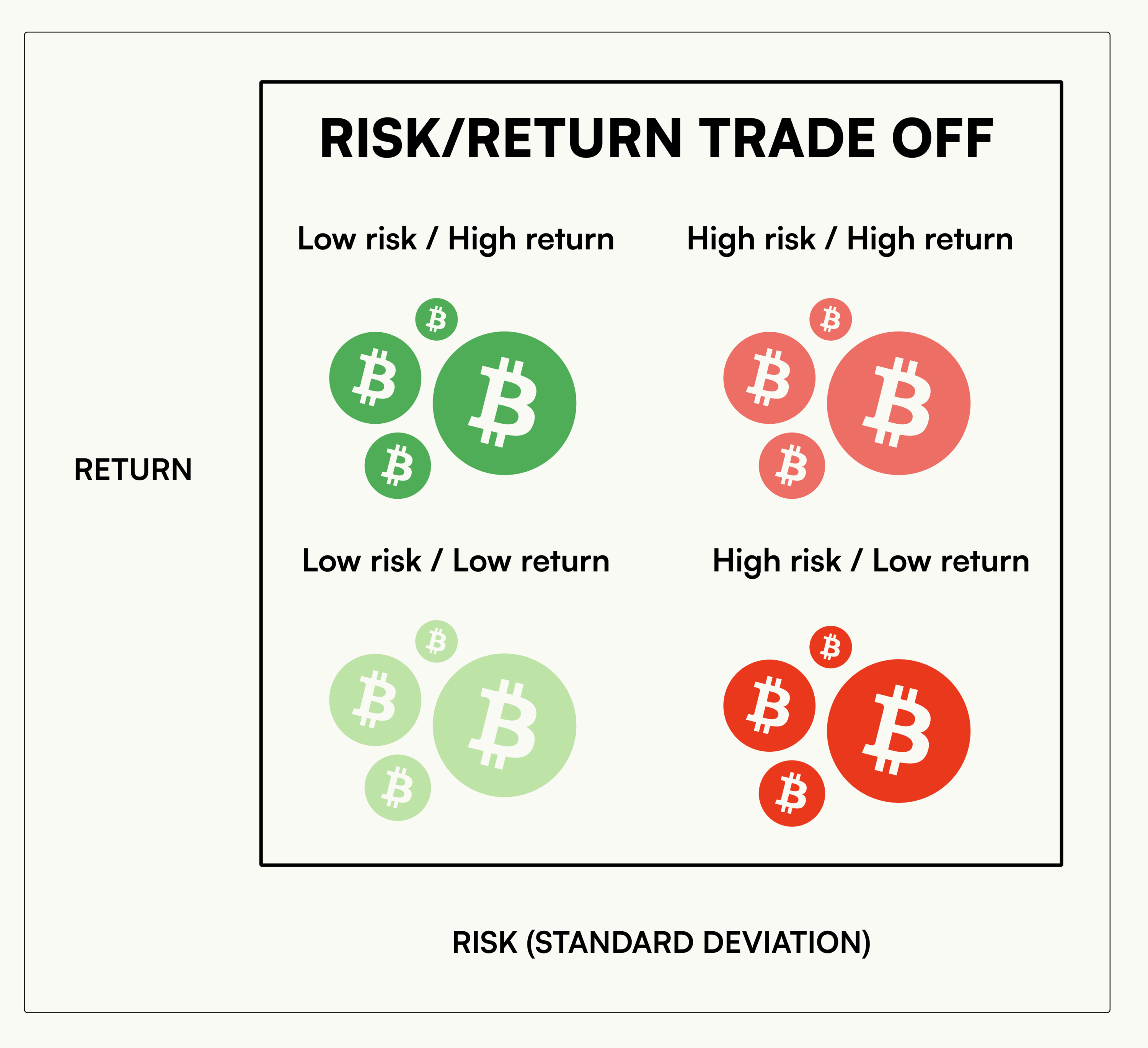

That is also what underwriting is for. Weak underwriting has driven many yield failures in crypto, so a higher standard means rigorous due diligence, independent verification, stress testing and standardised disclosure. In simple terms, institutions are trying to place every yield product on a risk versus return map before they allocate capital:

The current Bitcoin risk / return landscape relative to allocator expectations.

The conclusion

Bitcoin has proven itself as the world’s most reliable Settlement Layer. It is secure, immutable and trusted. But it does not offer yield and it never will at the base layer. Financialisation must occur on Execution Layers where Bitcoin can be structured into programmable, scalable and investable yield products.

The opportunity is enormous. At full maturity, more than five hundred billion dollars could flow into Bitcoin yield and lending markets. The winners will not be those who move the fastest. They will be the ones who build trust, control distribution and manage yield with institutional discipline.

Rootstock is playing that role. By solving bridging risk, closing the risk / reward mismatch, embedding high grade underwriting, managing yield credibly and building scaled partnerships, Rootstock is becoming the Execution Layer that brings Bitcoin’s financialisation to life.

The future of Bitcoin is not only to be held. It is to be put to work. The path forward belongs to the platforms that make that possible with clarity, trust and scale.