RootstockLabs has published the Institutional BTCFi Report, analytical study examining the development of Bitcoin-native decentralised finance (“BTCFi”) and the mechanisms through which institutions are researching ways to improve the efficiency of their Bitcoin holdings. The report evaluates emerging infrastructure trends on Bitcoin sidechains and identifies operational, security, and governance factors relevant to the responsible use of these technologies.

Why It Matters

Over 2.6 million BTC are currently held across ETFs, corporate treasuries, and mining reserves, yet more than 99% remains idle, generating no yield.

For institutions, this creates a new kind of drag:

- Custody costs between 10–50 basis points per year create guaranteed negative yield.

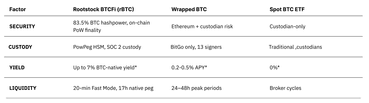

- Wrapped Bitcoin (WBTC), while popular in DeFi, depends on centralized minting and custodians, a structure that doesn’t meet institutional risk standards.

BTCFi, when built on Bitcoin-secured sidechains like Rootstock, changes that equation. The protocols integrated with Rootstock offer programmable yield, institutional-grade security, and on-chain settlement, all without compromising on Bitcoin’s core trust guarantees.

Key Findings

- Addressable idle BTC: ~2.6M BTC (ETFs + treasuries)

- BTCFi penetration: <0.8% of total BTC supply (~160k BTC deployed)

- Yield range: Up to ~7% APY across selected BTCFi strategies

- Custody drag: 10–50 bps/year in unavoidable holding costs

- Security foundation: Rootstock is merged-mined with over 83% of Bitcoin’s hashrate

BTCFi in Action

Institutions are already examining opportunities within the emerging BTCFi ecosystem. Several protocols have demonstrated how Bitcoin can be used as collateral within transparent, on-chain frameworks designed to enable lending, liquidity provision, or collateral management.

Examples observed in the market (as of August 2025) include:

| Protocol | Strategy Type | Approx. Yield |

| Sovryn Lending Pools | Variable lending | 0.5–6.5% APY |

| SolvBTC via Pendle | Tokenized yield | ~2–3% APY |

| MoneyOnChain BPro | Collateralized stable yield | ~4% APY |

| LayerBank Vaults | Fixed & variable-rate pools | — |

Each operates natively within the BTCFi ecosystem, leveraging Bitcoin as collateral, without wrapped tokens or off-chain dependencies.

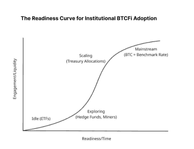

The Timing Is Right

Multiple catalysts are aligning to accelerate institutional BTCFi adoption:

- ETF inflows: $54B net since January 2024

- Corporate adoption: Nearly 1M BTC now on balance sheets

- Custody friction: 10–50 bps/year in cost inefficiency

- Wrapped token fatigue: Increasing redemption delays and centralization concerns

- Infrastructure readiness: Rootstock now secured by 83.5% of Bitcoin’s hashpower, with support from miners like SpiderPool and Foundry

Why Rootstock

Rootstock stands apart as the Bitcoin-secured smart contract layer designed for institutional confidence:

- Bitcoin-level security: Merged-mined with 83% of BTC’s hashrate

- Full EVM compatibility: Seamless deployment for Ethereum-based protocols

- Custody integrations: Supported by BitGo, Fireblocks, and Copper

- Compliance-ready design: Built with auditability and regulatory alignment in mind

Rootstock has been live on mainnet since 2018, operating as an open-source, decentralized network.

What’s Next

The BTCFi landscape is just beginning to scale.

- Institutions can now assess BTCFi within their existing treasury and risk frameworks.

- Protocols are expanding into structured lending, fixed income, and other institutional strategies.

- Governance, audit, and on-chain data standards are evolving to support larger capital inflows.

Transitioning from passive Bitcoin exposure to productive capital doesn’t require reinventing infrastructure, just connecting to new Bitcoin-native rails.

About the Institutional BTCFi Report

The Institutional BTCFi Report is RootstockLabs’ strategic analysis for institutional investors, treasurers, and allocators.

It provides detailed market insights, risk frameworks, case studies, and practical decision tools for understanding Bitcoin-native yield opportunities.

Disclaimer

The information provided in this report has been issued by Myosin. The contents of this report are intended for informational purposes only and do not constitute professional advice in finance, investment, legal, or any other field.

RootstockLabs does not endorse, operate, or provide access to any of the protocols mentioned in the report and announcement, nor does this publication constitute a recommendation to use or invest in them. Reported figures and product details are sourced from publicly available materials current as of the stated date and may not reflect future outcomes or performance.