Bitcoin is no longer just a hedge or an asset class. It is becoming infrastructure.

From sovereign wealth funds to S&P-listed firms, a growing cohort of institutions is now moving Bitcoin onto their balance sheets. These Bitcoin treasury companies are not just buying BTC. They are integrating it into their financial strategy.

What does this mean for capital allocators, risk managers, and investors? And what role does Bitcoin-native infrastructure like Rootstock play in supporting this new class of treasury holders?

The rise of Bitcoin treasury companies

A Bitcoin treasury company refers to any entity (public, private, or governmental) that holds Bitcoin as part of its balance sheet strategy. These holdings can serve various purposes:

- Long-term reserve asset

- Macro hedge against inflation or fiat devaluation

- Speculative position with asymmetric upside

- Strategic tool for decentralization, signaling, or investor alignment

The idea was popularized by Strategy in 2020. Today, it has become a broader movement reshaping capital management at scale.

Governments and companies are buying Bitcoin

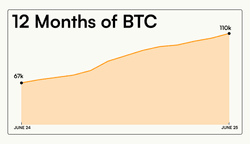

As of mid-2025, institutions hold over 1.5 million BTC, or roughly 7% of the total supply. These estimates come from a combination of SEC filings, blockchain forensics, and aggregated data from platforms like CoinMetrics and BitcoinTreasuries.net.

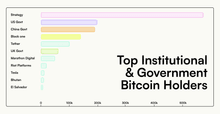

MicroStrategy (now Strategy) remains the largest known corporate holder, with 582,000 BTC as of June 2025. The U.S. government, following a March executive order establishing a Strategic Bitcoin Reserve, holds an estimated 200,000 BTC. This is largely from criminal asset forfeitures, as reported by Bloomberg and Coindesk.

China reportedly retains 190,000 BTC, mostly seized during the PlusToken crackdown. Other major holders include Block. one (140,000 BTC), Tether Holdings (100,520 BTC), Marathon Digital (49,000 BTC), and Tesla (11,509 BTC), based on public filings and attestations.

Note: Figures are based on public disclosures, regulatory filings, and estimates. Not all holdings are on-chain verified. Values are approximate as of June 2025.

How Bitcoin is held on the balance sheet

There are several common treasury models used to integrate Bitcoin into institutional finance:

1. Direct Holdings

Bitcoin is recorded directly on the parent company or sovereign balance sheet, without routing through a separate entity.

- Purpose: Opportunistic or strategic holdings with direct accounting treatment.

- Example: Tesla, acquired BTC in 2021 as a treasury diversification play. Tahini’s Restaurants (Canada), converted corporate reserves into BTC starting in 2020.

2. Reserve Purchases

Bitcoin accumulated under a declared, ongoing treasury reserve policy, often programmatic and long term.

- Purpose: Treat BTC as a core reserve asset, similar to gold, with the intent to hold indefinitely.

- Examples: Strategy (formerly MicroStrategy), 597,325 BTC as of June 30, 2025.

3. Subsidiary Holdings

Bitcoin held through a separate legal or accounting entity, such as a special purpose vehicle (SPV), foundation, or wholly owned subsidiary.

- Purpose: Create regulatory, tax, or operational separation from the parent entity.

- Example: Block.one, historically held 140,000 BTC via related entities.

4. Seized Asset Reserves

Bitcoin obtained by governments through law enforcement seizure, often temporary until auction or transfer.

- Purpose: Manage seized assets and occasionally reallocate to a strategic reserve.

- Example: United States, estimated 198,000 BTC mid-2025 from cases like Silk Road and Bitfinex.

5. Mining Accumulation

Bitcoin mined and retained instead of sold immediately.

- Purpose: Build strategic reserves through mining operations.

- Examples: Marathon Digital Holdings, 50,000 BTC held mid-2025.

The upside and downside of holding Bitcoin

As Bitcoin adoption accelerates across corporate and sovereign treasuries, decision-makers must weigh both the strategic benefits and the operational challenges of holding BTC on the balance sheet. Bitcoin offers asymmetric upside as a reserve asset, but it also introduces volatility, custody, and liquidity considerations that differ from traditional holdings.

Benefits:

- Long-term hedge against fiat debasement

- Treasury diversification and monetary independence

- Market signaling to shareholders and crypto-aligned users

- Early exposure to a scarce, appreciating digital asset

Risks:

- Volatility can impair earnings and trigger mark-to-market losses

- Shareholder resistance, as seen in Meta’s rejected BTC reserve vote

- Custodial complexity for large treasuries

- Liquidity bottlenecks during major selloffs (e.g., Germany’s 2024 offload)

Why idle Bitcoin is no longer an option

Bitcoin has proven itself as a reserve asset. But in 2025, holding it passively comes at a cost. In a yield-hungry, capital-efficient market, idle BTC is a missed opportunity, especially as traditional lenders fall out of favor and trustless infrastructure matures.

Today, treasuries and allocators are no longer asking if Bitcoin can work harder. They are asking how soon they can deploy it without leaving the Bitcoin economy or giving up custody.

Activating Bitcoin Capital with Rootstock

The first phase of institutional Bitcoin adoption was defined by accumulation. The second phase is about activation. It means putting Bitcoin to work without compromising on custody, transparency, or trust.

Rootstock is purpose-built for this next phase. By enabling Bitcoin-native smart contracts, secured by Bitcoin’s own hash power and fully EVM compatible, Rootstock gives institutions the infrastructure they need to transform idle BTC into productive capital within the Bitcoin economy.

Why Rootstock is the leading infrastructure for Bitcoin capital deployment:

- It enables on-chain lending and borrowing without custodial risk

- It supports BTC-backed stablecoins, unlocking liquidity while preserving long exposure

- It uses auditable smart contracts designed for institutional compliance

- It offers non-custodial infrastructure secured by merge-mined Bitcoin consensus

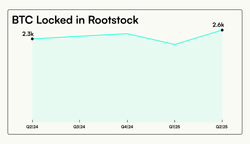

As of June 2025, over 2,600 BTC, valued at more than 225 million dollars, is deployed across Rootstock-native DeFi protocols. Two standout platforms in this next phase of adoption are:

Solv: Enables fixed-income strategies using smart vault architecture. Institutions can access tokenized BTC yield while maintaining cross-chain liquidity across Rootstock, Ethereum, and other major networks.

Pell: Introduces a Bitcoin-native restaking model, allowing BTC to serve as cryptoeconomic collateral. Treasuries can use Bitcoin to secure other networks and earn restaking rewards without compromising custody.

Together, these platforms reflect the evolution of Bitcoin from a passive reserve to an active, yield-generating asset—securely deployed through Rootstock infrastructure.

Ways strategic holders can put Bitcoin to work

With Bitcoin-native DeFi infrastructure now live, institutions have more options than ever to put BTC to work without giving up custody. Use cases include:

- Lending: Supply BTC and earn interest via non-custodial smart contracts

- Borrowing: Take loans against BTC without selling (preserve long exposure)

- Stablecoin minting: Use BTC as collateral to mint DoC and access dollar liquidity

- Structured yield products: Create programmable risk-return strategies

These options give treasuries the ability to generate yield, extend runway, and unlock liquidity, all while remaining anchored to Bitcoin’s security.

The institutional phase of Bitcoin

Bitcoin is no longer just a speculative asset. It has become a strategic reserve, actively held by public companies, sovereign treasuries, and long-term institutional allocators.

As Bitcoin moves onto the balance sheet, the question is shifting from whether to hold to how to use. Institutions and treasuries now seek yield, liquidity, and capital efficiency, without compromising custody or trust.

Rootstock provides the infrastructure to meet that demand. By enabling smart contracts secured by Bitcoin mining, Rootstock unlocks the most secure DeFi for BTC holder. It offers transparency, auditability, and alignment with institutional treasury standards.

Explore what Bitcoin can do when it works for you with Rootstock.