Rootstock ended the second quarter of 2025 with stronger usage, deeper liquidity, and steady technical progress. Messari’s State of Rootstock Q2 2025 report highlights a period where user activity and DeFi adoption advanced, reflecting the impact of lower fee structures. The results confirm Rootstock’s position as the leading Bitcoin DeFi layer, where long-term credibility and sustainable yield are taking shape.

Messari’s Insights

- User growth: Daily active addresses increased 65.3 percent quarter over quarter, with a record 8,307 new addresses.

- Staking Surge impact: The mid-May to mid-June campaign drove new account creation and boosted active participation.

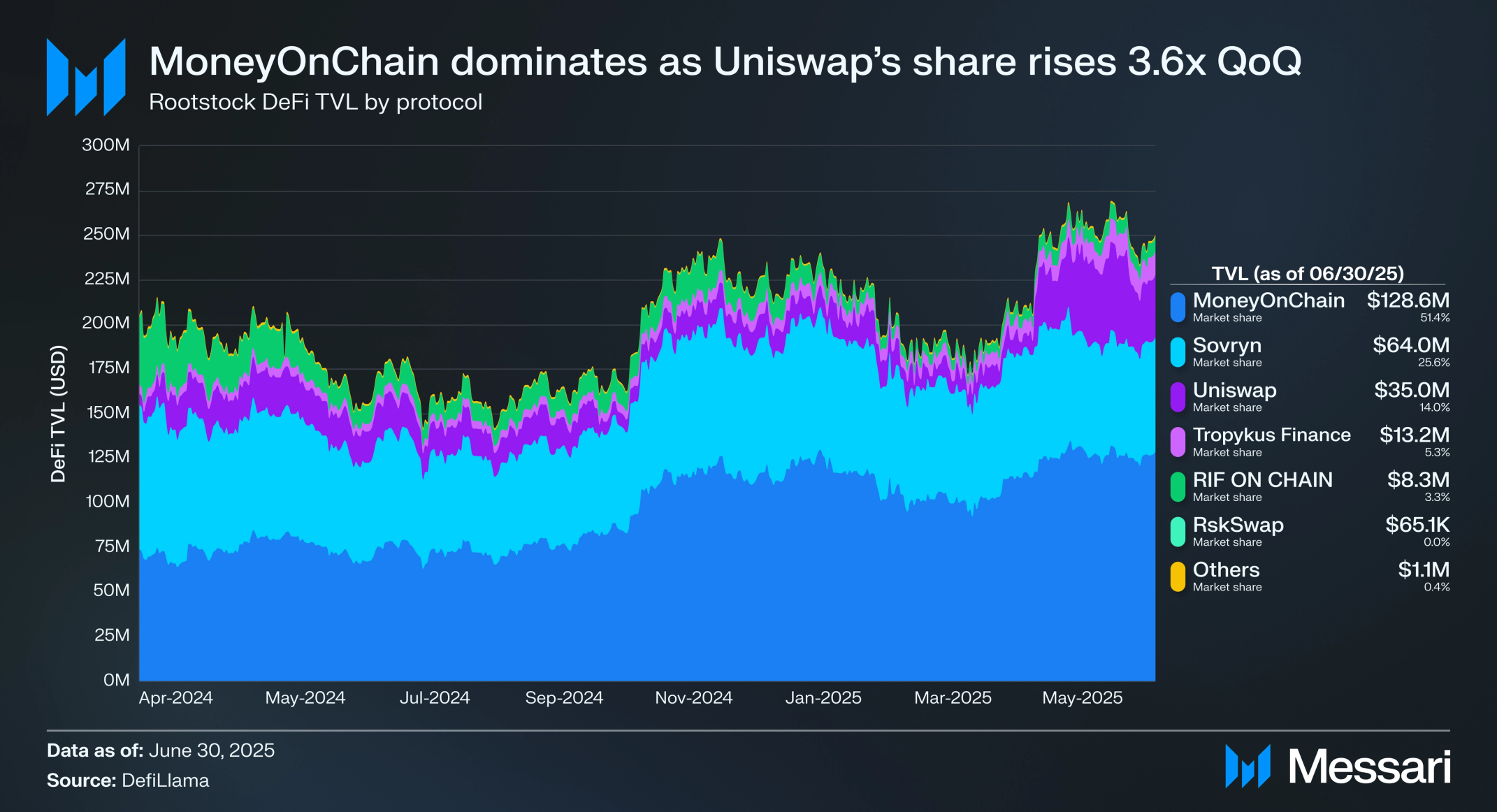

- Liquidity expansion: DeFi TVL rose 9.8 percent in Q2 to $235.9 million, with Uniswap liquidity jumping from $7 million to $35 million.

- Network security: Merged mining participation reached 87.1 percent, the highest level to date, further anchoring Rootstock to Bitcoin’s hash power.

These insights illustrate how Rootstock is managing a careful balance: reducing transaction costs for end users while continuing to scale adoption and liquidity.

Rootstock Metrics

The numbers behind Q2 provide a clear snapshot of Rootstock’s performance.

- Stable ecosystem growth: Transactions remained stable at 1.05 million for the quarter, a 1.1 percent increase from Q1. Daily volumes typically ranged between 7,000 and 13,000, with occasional peaks near 23,000.

- Protocol fees optimized for users: Protocol revenue declined 36.7 percent to $195,600 as fee optimizations reduced costs by more than 60 percent. Average fees fell to $0.19, the lowest in five quarters.

- Stablecoin adoption remained balanced: DOC held a 25.8 percent share of TVL, DLLR 24.5 percent, and USDT 23.1 percent.

- MoC, Sovryn, and Uniswap dominate TVL: MoneyOnChain retained dominance with $128.6 million in TVL, up 29.3 percent. Sovryn followed with $64 million, up 4 percent. Uniswap grew sharply to $35 million, a fourfold increase.

Credibility Signals

Several ecosystem developments in Q2 reinforced Rootstock’s position as a credible and secure environment for Bitcoin DeFi.

Q2 highlighted major steps forward in Rootstock’s credibility and infrastructure.

Trust-Minimized Bridging

Union Bridge was announced as an upcoming trust-minimized Bitcoin bridge, designed with fraud proofs and watchtower monitoring to enable secure BTC transfers between Bitcoin and Rootstock.

Research and Development

BitVMX FORCE was also introduced, an alliance of leading firms in the cryptography, open source, and blockchain technology space.

The aim of BitVMX Force is to foster and encourage collaboration between industry leaders to further optimize BitVMX and establish it as the go-to open-source framework to optimistically execute arbitrary programs on the Bitcoin network safely and securely.

Yield-Focused Integrations

New integrations strengthened the ecosystem. Midas integrated Rootstock, enabling mBTC and mTBILL to bring yield-bearing Bitcoin and tokenized U.S. Treasuries on chain, while Solv Protocol added rBTC and SolvBTC to unlock new liquidity opportunities across Rootstock DeFi.

Advanced Governance:

Governance advanced through RootstockCollective with three clear milestones:

- Onboarding of new delegates to expand representation

- Delivery of user experience improvements in proposal workflows

- Launch of the Shepherds program to support institutional grade decision-making

Together, these developments reinforce Rootstock’s long-term credibility and demonstrate its continued alignment with institutional standards.

Looking Ahead

Rootstock moves into the second half of 2025 with clear momentum. The Staking Surge campaign expanded the active user base. Liquidity recovery, led by Uniswap, signals broader adoption. Technical upgrades, including RSKIP 517 for block time stability, bridging improvements with PowPeg and Flyover, and The Graph integration for developers, strengthen the foundation for growth.

Key Takeaways

- Daily active addresses grew 65.3 percent in Q2.

- DeFi TVL rose 9.8 percent to $235.9 million.

- Merged mining participation reached 87.1 percent.

- Protocol revenue fell 36.7 percent as fees were optimized, lowering user costs.

Rootstock’s Q2 performance shows a network gaining strength in user growth, liquidity, and credibility. With sustainable fee structures, expanding DeFi participation, and technical resilience, Rootstock is positioned as the institutional gateway to Bitcoin-secured DeFi.

Learn about the opportunities offered by the Rootstock Ecosystem Partners for institutions.